When Reviewing the Net Present Profile for a Project

NPV Profile Meaning

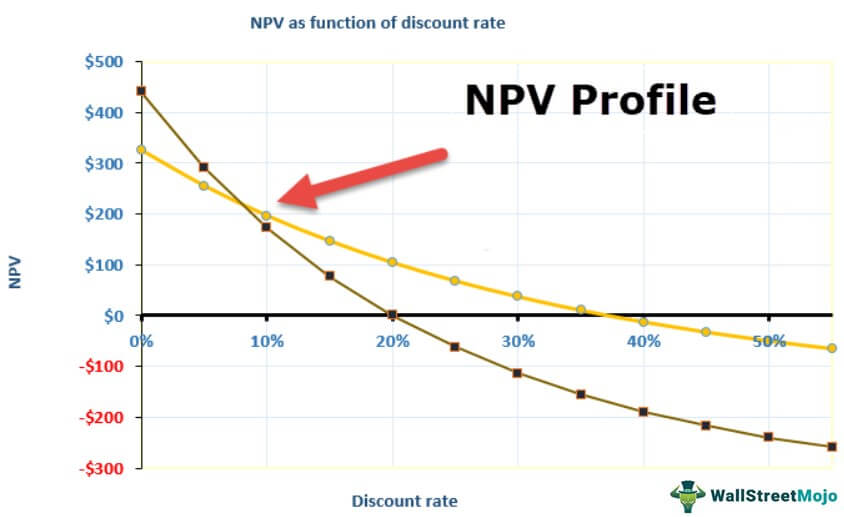

Internet present value (NPV) contour of the company refers to the graph which shows the internet present value of the project under consideration with respect to the respective various dissimilar charge per unit of the discount where internet present value of the projection is plotted on the Y-axis of the graph and the rate of the discount is plotted on the Ten-centrality of the graph.

The human relationship between the discount rate and NPV is inverse. When the discount rate is 0%, the NPV contour cuts the vertical centrality. NPV contour is sensitive to discount rates. College discount rates betoken the cash flows occurring sooner, which are influential to NPV. The initial investment is an outflow as it is the investment in the project.

You are free to use this image on your website, templates etc, Delight provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: NPV Contour (wallstreetmojo.com)

Components

The post-obit are components of NPV Profile

- Internal Charge per unit of Return (IRR): The rate of return, which does the projects NPV is zero, is called as IRR. It is one of the important factors while because a profitable project.

- Crossover Charge per unit: When 2 projects take the same NPV, i.e., when the NPV of two projects intersects each other, information technology is chosen a crossover rate.

If 2 projects are mutually exclusive, the discount rate is considered equally the deciding factor to differentiate betwixt the projects.

Steps to Prepare the NPV Profile

Consider in that location are two projects. To build an NPV profile, these steps take to be considered

Y'all are free to utilize this image on your website, templates etc, Delight provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: NPV Profile (wallstreetmojo.com)

- Step ane – Find the NPV of both projects at 0%.

- Notice the NPV for project A

- Find the NPV for project B

- Footstep 2 – Find the Internal Charge per unit of Render (IRR) for both projects.

- Find the IRR for Project A

- Find the IRR for Project B

- Step three – Find the crossover point

- If the NPV is greater than null, than accept the investment

- If the NPV is lower than zero, than reject the investment

- Of the NPV is equal to the investment, then information technology is marginal

These rules are applicable when it is assumed that the company has unlimited cash and fourth dimension to accept all projects that come up in their style. However, it is non true in the existent world. The companies unremarkably have limited resources and have to select a few of the many projects.

Examples

Allow us understand this meliorate by looking at an example.

Consider project A which requires an initial investment of $400 one thousand thousand. This project is expected to generate cash flows of $160 1000000 for the next four years.

Consider another project B, which requires an initial investment of $400 million and no cash flows in the side by side 3 years and $800 million in the last year.

To sympathise how sensitive these greenbacks flows are to the cash flows, let us consider multiple discount rates – 0%, 5%, ten%, 15%, 18.92%, and 20%

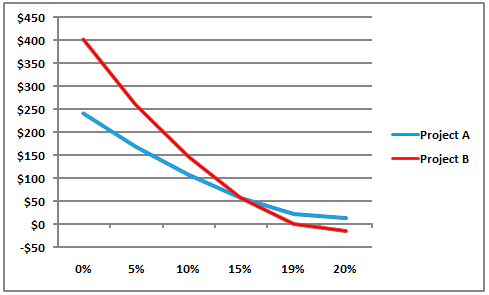

The cyberspace present value of these greenbacks flows can exist determined using these rates. This is shown below in a tabular format below.

| Disbelieve Rate | NPV for Project A | NPV for Project B |

|---|---|---|

| 0% | $240 | $400 |

| v% | $167.35 | $258.16 |

| 10% | $107.17 | $146.41 |

| 15% | $56.79 | $57.twoscore |

| eighteen.92% | $22.80 | 0 |

| 20% | $14.19 | $fourteen.19 |

Another important signal to be considered is that if Project Y is taken up at higher rates, than the project volition have a negative NPV and therefore be unprofitable

(Please note that there are various ways to calculate NPV(Internet Nowadays Value) Profile like the formula method, Financial estimator, and excel. The most popular method is the excel method)

Plotting this NPV Profile on a graph volition show the states the relationship between these projects. Using these points, we can too summate the crossover charge per unit, i.due east., the rate at which the NPV of both projects is equal.

The following graph is the NPV profile of project A and Project B.

As discussed above, somewhere effectually 15% is the crossover rate. This is depicted in the graph where the ii lines of Project A and Projection B run across.

For Project B, 18.92% is the charge per unit that makes the NPV of the projection zero. This rate is known equally the internal rate of return. As in the graph, this is where the line crosses the X-axis.

Looking at the different NPV (Net Present Value) profile values, it is conveyed that Project A performs ameliorate at 18.92% and 20%. On the other manus, Project Y performs better at five%, 10% as well as 15% as the disbelieve rate increases the NPV declines. This is also true in the real world when the discount rate increases, the business has to put more money into the projection; this increases the cost of the project. The steeper the curve, the more the project is sensitive to interest rates.

Consider a scenario where there are two projects which are mutually exclusive Mutually Sectional Projects is a term that is commonly used in the uppercase budgeting process where companies choose a single project based on sure parameters from a set of projects where acceptance of one project results in rejection of the other projects. read more than . In this example, the discount rate becomes the deciding factor. In our in a higher place example, when the rates are lower, project B performs better. Lower rates are to the left of the crossover rate.

On the other hand, projection A performs better at higher rates. That is on the right side of the cantankerous over-rate

Where are NPV Profiles Used?

NPV(Net Present Value) profiles are used by the companies for upper-case letter budgeting. Uppercase budgeting Capital letter budgeting is the planning process for the long-term investment that determines whether the projects are fruitful for the business concern and volition provide the required returns in the future years or not. Information technology is essential considering capital expenditure requires a considerable amount of funds. read more is the procedure that the business uses to make up one's mind which investments are profitable. The motive of these businesses is to brand profits for their investors, creditors, and others. This is only possible when the investment decisions they make results in increasing the disinterestedness. Other tools used are IRR, profitability alphabetize The profitability index shows the human relationship between the company projects time to come cash flows and initial investment by computing the ratio and analyzing the projection viability. Ane plus dividing the nowadays value of cash flows by initial investment is estimated. It is also known as the profit investment ratio every bit it analyses the project's profit. read more , payback menses, discounted payback period The discounted payback period is when the investment cash flow paybacks the initial investment, based on the fourth dimension value of money. It determines the expected render from a proposed uppercase investment opportunity. It adds discounting to the chief payback period determination, significantly enhancing the result accuracy. read more , and accounting rate of return.

The net present value Net Present Value (NPV) estimates the profitability of a project and is the deviation betwixt the nowadays value of cash inflows and the present value of cash outflows over the project's time period. If the difference is positive, the project is profitable; otherwise, information technology is non. read more mainly measures the net increase in the company's disinterestedness by working on a project. Information technology is essentially the difference betwixt the present value of cash flows and the initial investment based on the discount rate. The disbelieve rate is mainly decided on the basis of the debt and equity mix used to finance the investment and to pay for the debt. It too incorporates the adventure factor, which is inherent in the investment. Projects with positive NPV profile are considered the ones which maximize the NPV and are the ones selected for investment.

Recommended Articles

This has been a guide to NPV Profile. Here nosotros discuss the NPV Profile components, rules for acceptance, and rejection along with applied examples and uses. You can acquire more nigh financing from the following articles –

- Advantages and Disadvantages of NPV

- IRR Examples (Internal Charge per unit of Return)

- PV vs NPV

- NPV vs IRR – Compare

Source: https://www.wallstreetmojo.com/npv-profile/

0 Response to "When Reviewing the Net Present Profile for a Project"

Post a Comment